ObamaCare Premium Analysis

1

Executive Summary

Data analysis was performed on the recently published 2016 premium

data for the healthcare policies offered over the federal exchanges under the

Affordable Healthcare Act (colloquially referred to as ObamaCare). Obamacare is a politically charged subject,

has been litigated a number of times all the way to the supreme court, number

of bills passed by congress trying to defund it and a lot of articles have been

written in the past on its eventual failure from a death spiral event (wherein

only the sickest of the sick enroll in the plan, leading to an exponential

increase in premium that will make it unaffordable). Obamacare has survived a number of challenges

and has currently enrolled 13 million members (premium paying) across the US,

either through state or federal exchanges.

The current data analysis tries to shine some light on the premium data

and provide the general public a narrative of what the published premium data

tells us. All of the data analyses in

this document were done using Tableau public and there was some amount of data

shaping that was required before useful analyses could be done. Tableau public makes data shaping and

transformation easy. The data analyses

will be expanded over time as time permits and based on comments from

readers.

- The premium data only covered those states that don’t run their own exchanges and so are covered by federally run exchanges. These states are mostly controlled/leaning Republican. The average premium varies somewhat state by state. Hawaii had the lowest average premium for a family with two children and one of the couple with a maximum age of 40 with silver plan, at $831 per month in 2016. Excluding the outlier of Alaska, Wyoming had the highest premium for this same group at $1,471 per month. Alaska has very high premiums for all groups and shows a premium of $2,360 per month for this group. The big variation in the premium rates between states may be due to the enrollment differences between the states, risk pool differences and insurance competition as it is thought that the cost of healthcare couldn’t be that different among states. The average premium for a family with two children and one of the couple with a maximum age of 40 with silver plan across the various states is about $1,095 per month in 2016. The average premium for a family with two children and one of the couple with a maximum age of 50 with silver plan across the various states is about $1,387 per month in 2016. This increase in premium is expected with increase in age. More details on these premiums can be seen in the detailed sections and the Tableaupublic visuals.

- The premiums on average for a silver plan did increase on average by about 16.2% from 2015 to 2016 within the states covered by the federal exchanges. The gold and platinum plans had much higher increases. The premium increase YoY will have to be controlled to much lower percentages to keep the Obamacare plan viable for the long term. The current increase may be due to insurers learning the risk profile of the enrolled population and more rightly pricing these policies. The premium increases are not the same in the every state. Some states like Arizona and Mississippi had premium decreases in the silver plan. The -100% in the table refers to states that no longer are offering plans through the federal exchange in 2016 (as they most probably set up their own state exchange). The federal subsidies will increase with premium increases and essentially have no cap. The long term sustainability of Obamacare will depend on how much subsidy the society is willing tolerate to provide health care benefits to people earning between 100% to 400% of federal poverty level.

- A household of 4 members earning the median wages of $53,657 will be capped to a maximum monthly premium of $324.65 in 2016 for the basic silver plan, based on the premium credit formula. Based on the average monthly premium of $1,095 per month, the federal government will subsidize the difference of $770.35 through premium credits. The household can buy other metal plans but they can only apply the $770.35 as premium credits towards the other metal plans. ObamaCare’s Premium Tax Credits can be paid to the insurer in advance to lower the monthly premium on a Marketplace plan or adjusted on the tax returns. Tax Credits are based on income and available to folks making between 100% and 400% of the Federal Poverty Level FPL (between $11,770-$47,080 for an individual and between $24,250-$97,000 for a family of 4 in 2016).

- The basic silver plan only has an actuarial value of 70% - meaning the premiums collected from the group (after deducting administrative, marketing costs and profits that could be as high as 15% of the premium) would only cover 70% of the medical costs expected of the group. The other 30% of the costs for the group will be covered by the plan members through satisfaction of deductibles, copays, coinsurance. Obamacare offers another subsidy called Cost sharing reduction subsidy. For a household of 4 members earning the median wages, the subsidy would increase the actuarial value of the silver plan from 70% to 73% actuarial value – a 3% gain in actuarial value. This would represent about on average a subsidy of about $40 per month ($1095*0.85/0.7*0.03) to the household of 4 members earning the median wage. This is a much smaller number compared to the premium tax credits.

- The ACA includes three risk-sharing provisions intended to protect insurers financially, especially in the first few years the Exchanges are in effect. These risk-sharing programs are often called the “3 Rs” because they are Risk Adjustment, Reinsurance, and Risk Corridor. Risk adjustment is permanent, and redistributes funds from plans with lower-risk enrollees to plans with higher-risk enrollees. Plans with lower actuarial risk will make payments to higher risk plans and payments should net to zero. The reinsurance program (3 year temporary program), a key part of ObamaCare, creates a funding pool to help insurers pay off medical bills above a certain threshold. The reinsurance program paid a total of $7.9 billion in 2014, less than the $8.7 billion it collected in payments. The $800 million surplus will carry over into the next two years. The risk corridor program (3 year temporary program) limits losses and gains beyond an allowable range. Health & Human Services collects funds from plans with lower than expected claims and makes payments to plans with higher than expected claims. Congress had made sure this is revenue neutral by disallowing the CMS from paying out any shortfall in this program by inserting language in the budget spending bill. So these risk sharing programs do not create any additional government subsidies.

- Close to 13 million people enrolled into private health insurance plans via the Affordable Care Act's exchange marketplaces as of Jan 31st, 2016 (not counting the people who got coverage due to expansion of Medicaid). Let us assume these members are part of a household of 4 earning the median wages with one member at the most aged 40 and having the basic silver plan, to make the math easier. The estimated premium collected (premium paid by members + federal govt premium tax credit) from the whole group per year would then be $1,095*12* 13/4 = $43 billion. Assuming an administrative/marketing costs + profit margin running at 15% of premium, $37 billion per year would be spent on medical care (43*0.85). The members would also spend an additional $16 billion through deductibles/copays/coinsurance (37/0.7*0.3). So the total spent on medical care by the enrolled population in Obamacare is about $53 billion per year. The point of this calculation is that this medical cost (or more) was being spent before Obamacare by these members as part of the uninsured population. These costs were mostly spent at hospitals in the ER area and went through a gut wrenching collection process for the uninsureds and eventually most of them got written off/passed on as premium increases to the insureds. Obamacare has not created new healthcare costs but has brought the uninsured population within the ambit of the insureds and given them access to preventive care before the disease becomes worse. There are productivity improvements for the society from this that can’t be easily quantified.

- Based on the same calculations as above, the premium tax credits for the federal government would amount to about $770.35*12*13 mil members/4 members per household = $30 billion. The cost sharing subsidy would be about $40*12*13/4 = $1.6 billion. The federal subsidies are big numbers but are smaller compared to the other federal subsidies to low income population. In 2014, the federal government provided about $50 billion in housing assistance specifically designated for low-income households. Total Medicaid spending by the federal government and states are about $492 billion (including administrative costs). Medicaid expansion in Obamacare may have created an additional subsidy of $50 billion. Mortgage interest deduction costs at least $70 billion a year in tax subsidies and 77 percent of the benefits go to homeowners with incomes above $100,000. Farm subsidies are worth about $100 billion a year (which includes about $76 billion for Food Stamps and Nutrition). Obamacare bridges the gap for the population that can’t qualify for Medicaid but are still poor enough not able to afford to pay the full value of a private health plan without some federal subsidies. The federal subsidies will increase with premium increases as the maximum premium for a member is capped by the member’s income in relation to the federal poverty level.

- As the percentage of Uninsureds come down over time with Obamacare, it may be time to question the non-profit status of many of the Hospital systems – the taxes on the Hospital systems may be able to plug some of the subsidies in Obamacare.

2 Obamacare Premium Data Analysis

Healthcare.gov publishes the premium data for the states

that are serviced by the federal exchange (because the states haven’t

implemented their own state exchanges).

All the data analysis for 2015 and 2016 are based on this published set of data.

2.1

Obamacare basics

Obamacare or the Affordable Healthcare Act (ACA) healthcare

exchanges went into effect in 2014. Some

of the basics of Obamacare are shown in pictures below. The marketplace health insurance plans are

essentially coded as different Metal plans and the Bronze Metal plan has the

lowest benefits (and lower premium) while the Platinum Metal plan has the

highest benefits (and higher premium).

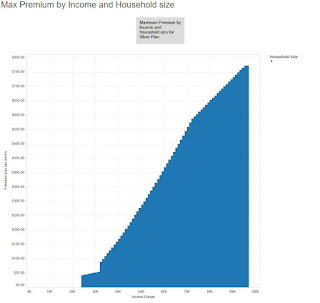

The federal poverty dollars in the picture refers to 2013. Figure 3 shows the maximum premium based on

2013 100% federal poverty level. For the

calendar year 2016, the maximum premium will be based on the 2015 100% federal

poverty level (Table 1). Figure 9 shows

the maximum premium graph for a household size of 4 for the Silver Plan at

different income levels. The Tableau

public visualization has an interactive version of this figure. The premium tax subsidies are calculated

based on the maximum premium for the lowest cost Silver metal plan offered in

the county you reside.

Figure 1: Eligibility for Obamacare

Figure 2: Different

Metal Level Plans and the amount of covered expenses for each plan

Figure 3: Maximum

Monthly Premium for different Household Income and Household size (2014

premiums based on 2013 federal poverty level)

Table 1:

100% Federal Poverty Level for 2015

The details on the reinsurance programs within the Obamacare

policies are beyond the scope of this analysis.

2.2 Obamacare Premium Analysis

The interactive link for all the visuals around the premium

analyses can be found at Obamacare Premium Analysis on Tableau Public.

2.2.1

Obamacare Premiums by County, State

The two figures (4 and 5) below show the various premiums by

Metal plan and Member Type for the St. Louis County in MO and the Davidson County

(Nashville) in Tennessee. The

interactive table can be used to analyze the premiums in various ways.

Figure 4: Premiums for St. Louis county in MO by Metal

Plan, Member Type, Plan Type

Figure 5: Premiums for Davidson county in TN by Metal

Plan, Member Type, Plan Type

2.2.2

Obamacare Premiums across various States

Figure 6 shows the premiums across the various states by

metal level, plan type and member type.

There is quite a bit of variation in the premiums between the

states. The figure below excludes the

state of Alaska as the premium is Alaska is very high and considered an outlier

for calculating the average premium across all the states covered by the

federal exchanges.

Figure 6: Premiums across the various States by metal

level, Plan Type, Member type for 2016

2.2.3

Obamacare Premiums by individual type and number

of children

Figure 7 shows the premium variation by individual type,

number of children and Metal level. The

increase in the premiums from the age of 21 to 40 is gradual but increases more

rapidly as one moves from age 40 to 50 to 60.

One can see the increase very clearly in Figure 8.

Figure 7: Premiums by Individual Type (couple or

individual), Metal level and Number of Children for 2016

Figure 8: Premium bar graphs by Individual Type (couple

or individual), Metal level and Number of Children for 2016

2.2.4

Obamacare Premium increase from 2015 to 2016

The premiums did increase overall from 2015 to 2016. The premium increases are not the same across

the states. Some states like Arizona and

Mississippi have premium decreases. The

average premium increase of 16.2% for the Silver plan is very high and

Obamacare won’t be sustainable if these yearly increases continue at this

pace. The higher rate of premium

increases will increase the level of subsidy on the premium credit by the federal

government and once the level of subsidy per member passes a certain number

(like say $4000 per member per year), the political voices will grow even

shriller against Obamacare.

2.3 Obamacare Maximum Premium

To make the Health insurance affordable, Obamacare caps the

monthly premium based on household income compared to the 100% federal poverty

level. The federal government pays a tax

credit (or subsidy) to bridge the difference between the healthcare exchange

premium and the maximum premium. The tax

credit is calculated based on the premiums for the lowest silver metal plan offered

in a household’s county. The household

can buy other metal plans but the tax credit will be equal to the credit

calculated based on the silver metal plan premium. Figure 9 shows the maximum premium as a

function of pre-tax income and household size.

The tax credit can be calculated by looking at the premium for the

silver metal plan and then deducting the maximum premium from it. The interactive version of the maximum

premium can be found here.

Figure 9: Maximum premium as a function of pre-tax income

and household size

No comments:

Post a Comment